- NJASA

- Financial Corner June 2025

-

SEHBP Retirees Who Are on Medicare May Be Eligible for Reimbursement of Both Medicare AND IRMAA Payments

School employees who retire with 25 or more years of service credit or with a Disability Retirement are eligible for a full reimbursement of the standard Medicare Part B premium and the Income-Related Monthly Adjustment Amount (IRMAA) surcharges paid for Medicare Part B and Part D coverage.

ENROLLMENT

Upon retirement, if you and/or your dependent are 65 or over, or have been on Social Security Disability for 24 months or more, you must enroll in Medicare Parts A & B to continue participating in the School Employees’ Health Benefits Program (SEHBP). If you have not enrolled in Medicare Part A and Part B, you should go to www.ssa.gov to apply no sooner than 90 days prior to your retirement date. If in retirement you are collecting Social Security retirement benefits (income), the Centers for Medicare and Medicaid Services (CMS) will notify the SEHBP of your enrollment. CMS will mail you your Medicare Part A and Part B card. Generally, this requires no action on your part, unless specifically requested.

If you have been retired, are approaching age 65 and not taking Social Security benefits, you will receive a letter from the NJ Division of Pensions and Benefits (NJDPB) instructing you to apply for Medicare Parts A and B to remain in the SEHBP.

If you are 65 at the time of your retirement, you will receive correspondence requesting proof of enrollment in Medicare Part A and Part B for yourself and/or your dependent(s). This proof includes the Medicare ID number as well as the effective dates for both Part A and Part B. You will need to enter this information into Benefitsolver.

INCOME-RELATED MONTHLY ADJUSTMENT AMOUNT (IRMAA) and MODIFIED ADJUSTED GROSS INCOME (MAGI)

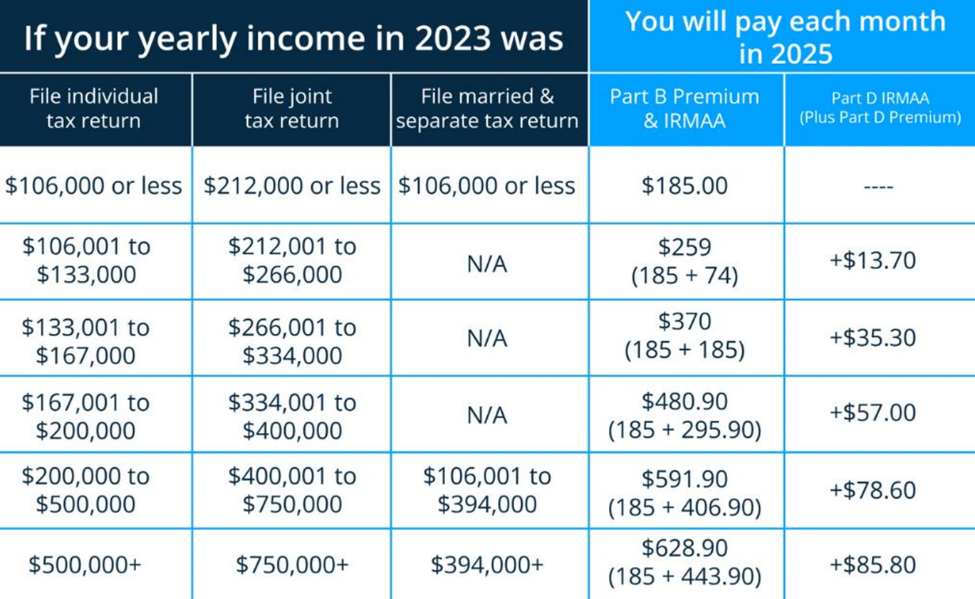

Every November, retirees who are enrolled in Medicare will receive a letter from Social Security indicating the following year’s Medicare Part B premium. The new amount will be effective beginning in January. Some individuals may pay a surcharge for Medicare Part B and Part D coverage based upon their income. This surcharge is the Income-Related Monthly Adjustment Amount (IRMAA). The amount of the individual's IRMAA surcharge is based on their Modified Adjusted Gross Income (MAGI) that was reported to the Internal Revenue Service two-years prior. The standard Medicare premiums are increased by the surcharge imposed when the MAGI exceeds certain levels, which are adjusted annually by the IRS. For example, the 2025 IRMAA is based upon MAGI from the 2023 tax return. Medicare enrollees are billed for at least the base Medicare Part B premium amount which is $185.00 a month in 2025. See the chart below for the six IRMAA income levels.

Retirees must pay the premiums due for Medicare Part B and IRMAA (if applicable) to CMS. If you or your dependent(s) are receiving Social Security Income benefits, this payment will be automatically deducted from your Social Security monthly check.

IRMAA REIMBURSEMENT

All retirees in the SEHBP who qualify for free or cost-shared health benefits and are enrolled in Medicare will receive reimbursement for the base Medicare Part B premium level in their monthly pension check. This reimbursement is for the retiree and their spouse. If your monthly Medicare payment includes the IRMAA, you will have the opportunity in the following year to apply for reimbursement of that additional premium amount.

Every February, all Medicare-eligible retirees in the SEHBP will receive a letter from Benefitsolver indicating that if you paid IRMAA surcharges in the prior year, you may apply for reimbursement. If you qualify, you must submit a claim for IRMAA reimbursement for yourself and/or your qualified spouse, civil union partner, or same-sex domestic partner. Once the IRMAA reimbursement begins, claims can be processed through Benefitsolver. All claims must be submitted before the deadline indicated in the IRMAA reimbursement notification. It is important to note that the reimbursement period window is limited to March through May.

You will find the information in your Benefitsolver account when you log in to the Members Benefit Online System (MBOS) and click on Health Benefits. The information includes all the filing instructions and the claim form to submit by mail, e-mail, or fax. If you submit your claim online through your Benefitsolver account, this is the fastest way to receive your reimbursement! Simply scan the required documents and drop them into the application. In addition to the IRMAA FAQ on the Health Benefits page, you will find a detailed video that shows you step-by-step how to file.

SUPPORTING DOCUMENTS

Supporting documentation is required along with the online or paper claim form. You will need: a copy of the Cost-of-Living Adjustment (COLA) letter sent by the Social Security Administration regarding the claim year's Medicare premiums and surcharges; a copy of the first two pages of your federal income tax form for the preceding year. If you are not collecting Social Security and paid your Medicare premium monthly, you must submit a Medicare Premium Bill (MPB). This can be found in your Medicare account at www.medicare.gov. You can also print the payment history as proof of payment.

CALCULATING PAYMENT

To calculate your payment amount, use the chart below. Note that separate reimbursements must be submitted for both Medicare Part B and Medicare Part D. When submitting online, separate reimbursements must be submitted for each person, including your spouse. To calculate your surcharge amount, identify the number of months for which you are seeking reimbursement. Then take the number of months and multiply it by the applicable monthly surcharge amount below. Please note that two claims per retiree must be filed, one for Part B and another for Part D.

2025 IRMAA INCOME BRACKETS AND PREMIUMS

Information taken from www.cms.gov

If you need assistance on this or any other pension and retirement topics, don’t hesitate to contact Ginger Thompson at gingert@njasa.net to request an appointment with Carmine Anzalone.